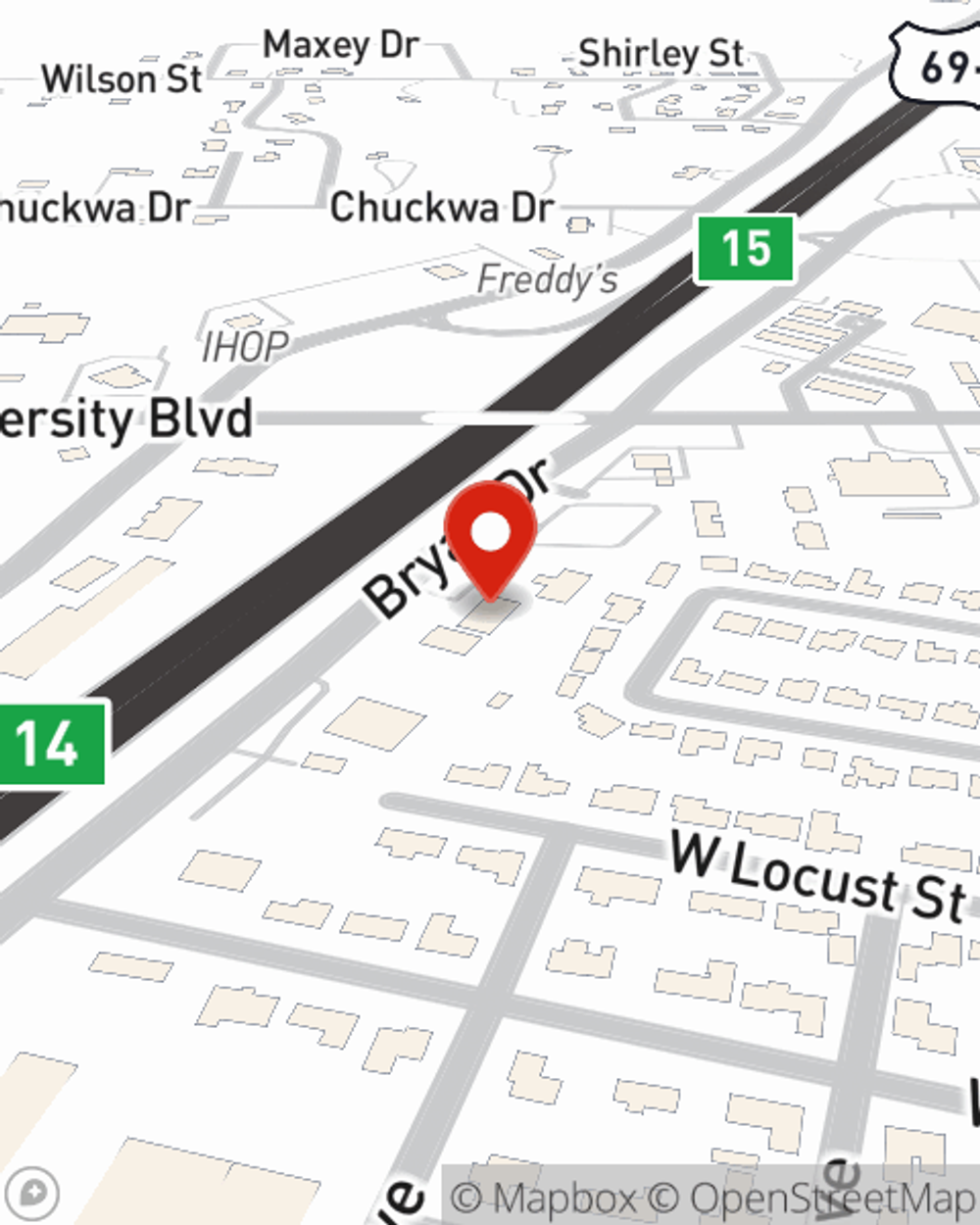

Life Insurance in and around Durant

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Purchasing life insurance coverage can be a lot to consider with a variety of options out there, but with State Farm, you can be sure to receive considerate caring service. State Farm understands that your ultimate goal is to help provide for your partner.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Durant Chooses Life Insurance From State Farm

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Greg Phillips stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

It's always a good time to make sure your loved ones have coverage against the unexpected. Reach out to Greg Phillips's office to learn more about State Farm's Life insurance options.

Have More Questions About Life Insurance?

Call Greg at (580) 924-1212 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Greg Phillips

State Farm® Insurance AgentSimple Insights®

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.